National Pension: Essential Guide To Japan's Public Pension System, is it useful? What you need to know and why?

Editor's Notes: "National Pension: Essential Guide To Japan's Public Pension System" have published today date. These days getting retirement benefits is one of the important things that we are keen to learn. It helps to make our retired life secure and carefree. Especially when it’s about Japan's public pension. The National Pension is a public pension system in Japan that provides basic pension benefits to all residents of Japan aged 20 or older. The system is funded by contributions from employees, self-employed individuals, and the government. As to make an appropriate decision about this topic, we did some analysis, digging information, made National Pension: Essential Guide To Japan's Public Pension System we put together this National Pension: Essential Guide To Japan's Public Pension System guide to help you to make the right decision.

Key differences or Key takeways

| Feature | National Pension |

|---|---|

| Eligibility | All residents of Japan aged 20 or older |

| Contribution rate | 18.3% of income (14.2% for employees) |

| Benefit amount | Up to 650,000 yen per month |

| Retirement age | 65 years old |

FAQ

This thorough FAQ section in the "National Pension: Essential Guide To Japan's Public Pension System" National Pension: Essential Guide To Japan's Public Pension System addresses several common misconceptions or concerns.

Question 1:

...

Minnesota Ranks #36 for How Well Public Pension Plans are Funded - Source www.americanexperiment.org

Tips

The National Pension System in Japan offers a range of benefits and options to secure financial stability during retirement. To make the most of this system, consider these tips:

Tip 1: Start contributing early and consistently

Joining the National Pension System as soon as possible ensures a longer contribution period, leading to higher pension benefits upon retirement. Consistent payments, even small amounts, help build up the pension balance over time.

Tip 2: Understand the different types of pensions

The National Pension System offers two types of pensions: Basic Pension and Additional Pension. Basic Pension is available to all contributors, while Additional Pension is optional and provides extra benefits based on additional contributions.

Tip 3: Consider voluntary contributions

Voluntary contributions allow individuals to increase their pension benefits beyond the standard contributions. This option is especially beneficial for those who wish to retire early or supplement their pension earnings.

Tip 4: Utilize government support programs

The Japanese government offers various support programs for individuals facing difficulties in making pension contributions. These programs include payment deferrals, exemptions, and subsidies.

Tip 5: Seek professional advice if needed

Navigating pension systems can be complex. Consider seeking professional advice from financial planners or pension experts to ensure optimal planning and decision-making.

Japanese Pension System | Registering for the National Pension System - Source lifeguide.tokyo

By following these tips, individuals can maximize their pension benefits and secure a comfortable retirement in Japan's National Pension System.

National Pension: Essential Guide To Japan's Public Pension System

Japan's National Pension System is a crucial safety net for retirees, providing a basic level of financial security in old age. Understanding its key aspects is essential for ensuring a comfortable retirement.

Understanding these key aspects is crucial for making informed decisions about pension contributions and planning for retirement. The National Pension System ensures that all Japanese residents have a secure financial foundation in their later years.

Colorado lawmakers advance climate bill but strip pension system - Source coloradonewsline.com

National Pension: Essential Guide To Japan's Public Pension System

The National Pension is a public pension system in Japan that provides basic income security for all residents aged 20 and over. It is an essential part of Japan's social security system, and it is important to understand how it works in order to plan for your retirement.

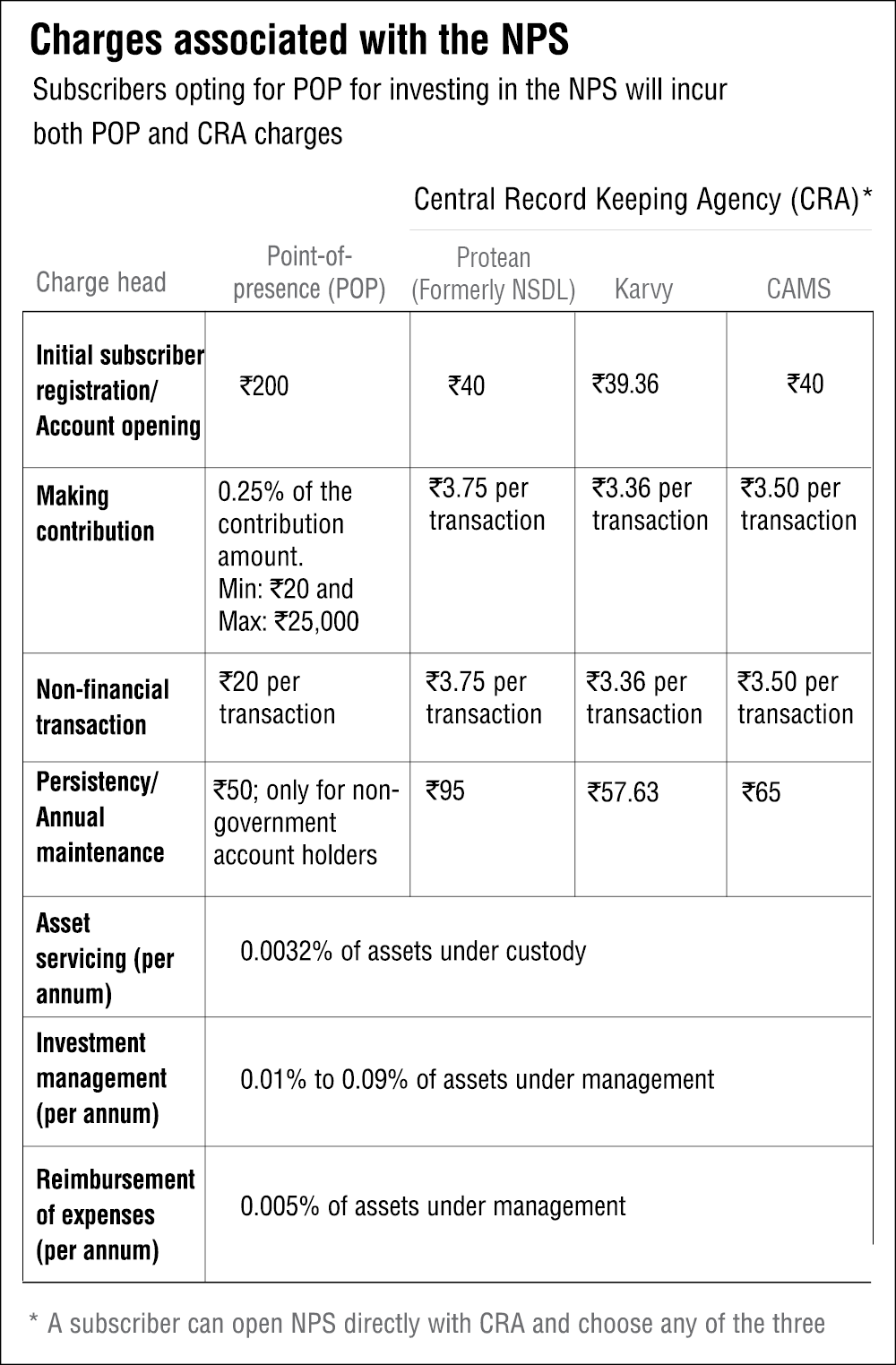

National Pension System: NPS Scheme, NPS Scheme Details | Value Research - Source www.valueresearchonline.com

The National Pension is funded by contributions from workers and their employers. The amount of your contribution is based on your income, and it is deducted from your paycheck each month. The government also provides subsidies to help low-income earners pay their contributions.

The amount of your pension benefit is based on the amount of contributions you have made over your lifetime. The longer you work and the more you contribute, the higher your pension benefit will be. You can start receiving your pension benefit at age 65, or you can choose to defer it until a later age to receive a higher monthly benefit.

The National Pension is an important part of Japan's social security system. It provides basic income security for all residents aged 20 and over, and it helps to ensure that everyone has a secure retirement.

Table: Key Features of the National Pension

| Feature | Description |

|---|---|

| Eligibility | All residents of Japan aged 20 and over |

| Contributions | Based on income, deducted from paycheck |

| Government subsidies | Available for low-income earners |

| Pension benefit | Based on lifetime contributions |

| Retirement age | 65, or can be deferred for a higher monthly benefit |